Business Insurance in and around Bedford

One of the top small business insurance companies in Bedford, and beyond.

No funny business here

This Coverage Is Worth It.

Whether you own a a tailoring service, a pharmacy, or a confectionary, State Farm has small business coverage that can help. That way, amid all the different moving pieces and options, you can focus on making this adventure a success.

One of the top small business insurance companies in Bedford, and beyond.

No funny business here

Insurance Designed For Small Business

When one is as driven about their small business as you are, it is understandable to want to make sure all systems are a go. That's why State Farm has coverage options for commercial liability umbrella policies, artisan and service contractors, commercial auto, and more.

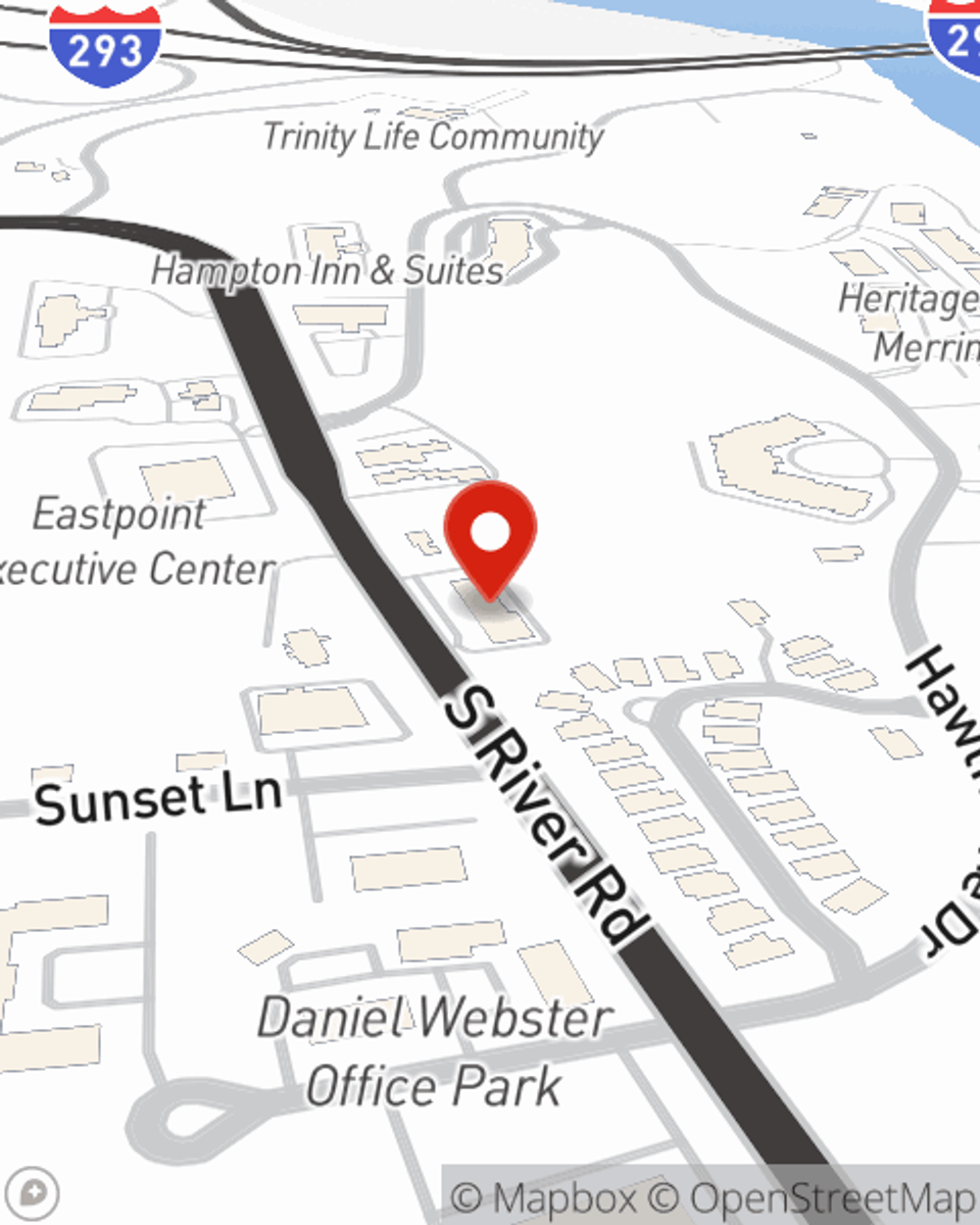

The right coverages can help keep your business safe. Consider reaching out to State Farm agent Jacob L. Bramel's office today to discover your options and get started!

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Jacob L. Bramel

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.